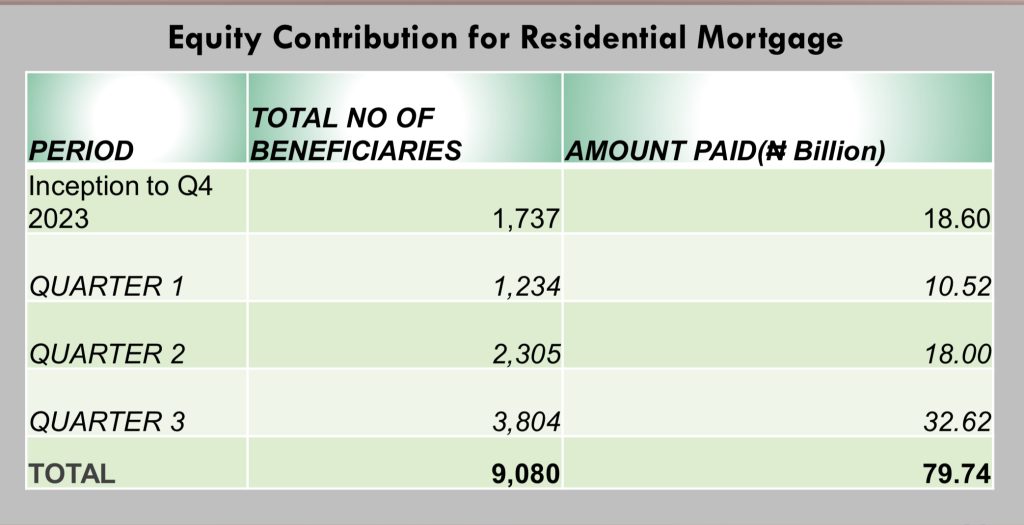

9,080 workers withdraw N79.74bn pension savings for residential mortgage – PenCom

Source: PenCom

Nike Popoola

No fewer than 9,080 workers under the Contributory Pension Scheme have withdrawn N79.74bn from their Retirement Savings Accounts (RSA) with their respective Pension Funds Administrators (PFA) for residential mortgage as of the end of third quarter 2024.

The National Pension Commission (PenCom), disclosed this in its report titled, ‘Pension industry dashboard,’ obtained by Dailyeconomy on Saturday.

Towards the end of 2022, PenCom approved the guidelines to access RSA balance for payment of equity contribution for residential mortgage by workers.

According to PenCom, equity contribution for residential mortgage is the portion of funds that RSA holders can apply from their RSA balance towards the payment required to secure a residential mortgage.

It adds that RSA holders are permitted to utilize a maximum of 25% of their RSA balance for this purpose.

How to apply for residential mortgage

– The applicant shall obtain a property offer letter from the property owner or

approved agent and approach a Mortgage Lender.

-The applicant shall fill an application for mortgage, which shall be provided

by the Mortgage Lender and attach the property offer letter.

-The application form shall contain the following minimum information:

I. Full name of the RSA holder

II. PIN of the RSA holder

III. Name of the Mortgage Lender

IV. Value of the property

V. Name of his/her spouse (if it is a joint mortgage)

VI. Evidence of marriage (If it is a joint mortgage)

VII. PIN of his/her spouse (If it is a joint mortgage)

VIII. PFA of his/her spouse (If it is a joint mortgage)

IX. Amount of equity payable by each applicant in a joint application

– The Mortgage Lender shall review the application form and verify the

genuineness of the property offer.

-The Mortgage Lender shall do its due diligence to ensure that the property

has a valuation report.

-Upon confirmation of the property offer letter, the applicant shall approach

his/her PFA and request for his/her RSA Statement for the purpose of

accessing the 25% of his/her RSA balance for payment of equity

contribution.

– In a joint application, each party shall apply to their respective PFA’s with

copies of the verified property offer letter.

-The PFA shall issue a duly endorsed RSA statement to the applicant, which

the applicant shall forward to his/her Mortgage Lender.

-The PFA shall update record on Applications for Equity Contribution for

Residential Mortgage upon issuing the RSA Statement to RSA holder.

-Upon receipt of the duly endorsed RSA statement, the Mortgage Lender

shall verify if the 25% of the applicant’s RSA balance will be sufficient as

equity contribution.

-Where 25% of the RSA balance is sufficient as equity contribution, the

Mortgage Lender shall issue a mortgage offer letter to the applicant.

-Where 25% of the RSA balance(s) is not sufficient, the Mortgage Lender

shall request for the payment of supplementary equity contribution from the

applicant(s).

-Upon confirmation of payment of supplementary equity contribution, the

Mortgage Lender shall issue a mortgage offer to the applicant(s).

-Within two working days of the issuance of the mortgage offer letter to the

applicant(s), the Mortgage Lender shall forward a copy of the mortgage offer

letter and the under listed documents/ additional information to the

applicant(s) PFA:

I. Copy of the mortgage application form

II. Verified property offer letter, which should contain, at the minimum, the

value of property, type of property and address of the property

III. Loan amount

IV. Equity contribution required

V. Bank account details of the applicant with the Mortgage Lender

VI. Indemnity by the Mortgage Lender to the PFA on the use of the equity

contribution.

VII. Evidence of payment of difference where 25% of RSA cannot cover the

equity required

-The applicant may after two working days of receiving his/her mortgage offer

letter, approach his/her PFA to request for payment of his/her Equity

Contribution for Residential Mortgage.

-The applicant shall obtain and fill an Application Form, with indemnity to the

PFA, for the payment of his/her Equity Contribution for Residential Mortgage.

-In a joint application, each party shall apply to their respective PFA with a

copy of the mortgage offer letter.

-The application form shall contain the following minimum information:

I. Full name of the RSA holder and RSA PIN

II. Type of mortgage (single or joint mortgage)

III. Full name and address of the Mortgage Lender

IV. Name and address of the property

V. The type of property e.g 1,2,3…. Bedrooms, Bungalow, Semi-detached

or detached.

VI. Total value of the property

VII. Total value of RSA balance as at date of applying for RSA Statement

VIII. Equity amount which shall be equal or less than 25% of the RSA

balance

IX. Name of the spouse and RSA PIN (for joint mortgage only)

X. Name of the spouse’s PFA (for joint mortgage only)

XI. The amount of equity payable by each party in a joint application

XII. Evidence of supplementary payment where 25% of the applicant’s RSA

balance is below the required equity contribution for his/her residential

mortgage.

– The PFA shall review the application form and the supporting documents

received from the Mortgage Lender for completeness using a checklist of

requirements within two working days.

+Upon successful completion of the documentation review, the PFA shall

update the applicant’s Mandate File within two working days.

-If any exceptions or discrepancies are identified during the documentation

review, the PFA shall communicate the exceptions to the Mortgage Lender

within two working days of identifying such exceptions.

– The PFA shall compute and validate that the requested amount is not more

than 25% of his/her RSA Balance.

– The PFA shall then process the application and forward same to the

Commission within two working days of successful documentation.