African regulators, operators brainstorm to address climate change impact at Continental Re summit

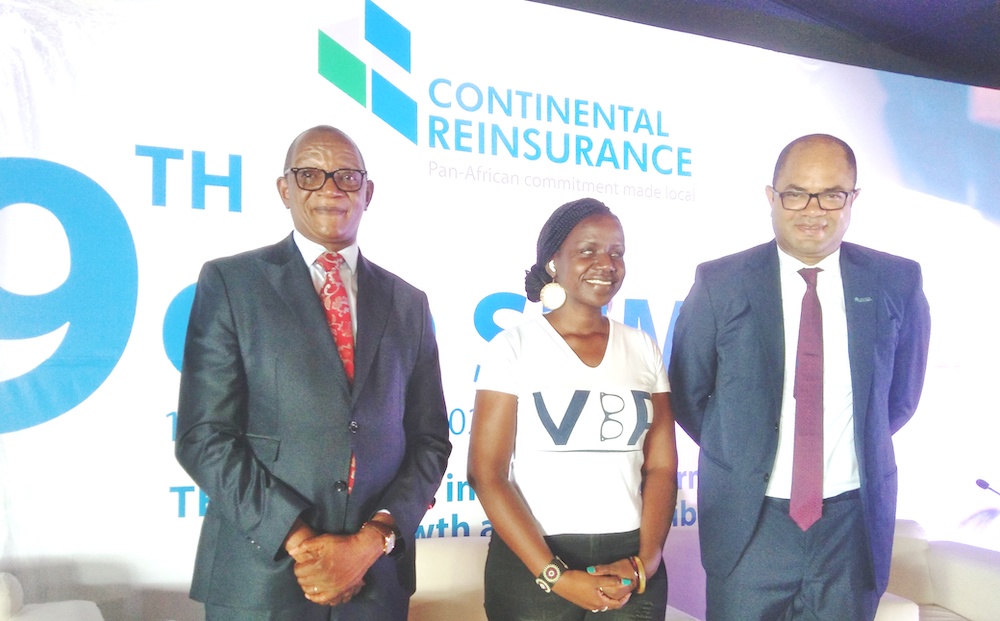

L-R: Group Managing Director, Continental Reinsurance Plc, Mr Lawrence Nazare; Senator, Parliament of the Republic of Kenya, Crystal Asige; and Executive Director, Technical Operations, Chukwuemeka Akwiwu, during the 9th CEO summit by Continental Reinsurance at Victoria Falls, Safari Lodge, Zimbabwe, on Thursday. Picture: Daily Economy

Nike Popoola,

Zimbabwe Operators and regulators in the African insurance industry have emphasised the relevance of

prioritising Environmental, Social and Governance compliance (ESG).

They spoke at the two-day 9th CEO summit organised by Continental Reinsurance Plc in Victoria Falls, Safari Lodge, Zimbabwe, which commenced on Thursday.

The summit was themed, ‘Unity in diversity: Harmonising growth and responsibility in African insurance’.

It was largely attended by insurance regulators, chief executive officers and other senior management officials in insurance and reinsurance companies across the African continent, and covered by Daily Economy.

Some of the participants at the event included Senator, Parliament of the Republic of Kenya, Crystal Asige; Commissioner, Insurance and Pension Commission, Zimbabwe, Dr Grace Muradzikwe; and Registrar & Chief Executive Officer, Pension and Insurance Authority, Zambia, Mrs Namakau Ntini.

The Commissioner for Insurance, National Insurance Commission, Nigeria, Mr Sunday Thomas, was expected to address the participants virtually.

While giving the opening remark, the Group Managing Director, Continental Reinsurance Plc, Mr Lawrence Nazare, said, “The pervasive and dramatic impact of climate change on our environment and the extreme weather phenomena and events it brings must be top of mind in any discourse.

“Pressing challenges underscore the need for governments and regulators to adapt and manage unanticipated multiple scenarios.”

He said the varied programmes at the event highlights key considerations that are at the confluence of ESG, and day to day challenges that stakeholders face in business.

The setting of Victoria Falls, he said, serves as a microcosm, showcasing the challenges faced in navigating towards ESG compliance, as the future seems to consistently overwhelm the present capacity to cope.

The group managing director stated that, “This town is Zimbabwe’s tourism hottest spot. Job seekers flock from all corners of the country, and the population has burgeoned from a manageable 15,000 in 2005 to over 50,000 in 2022.

“This highlighting the dilemma we face in maintaining sustainable natural environments, but also the obvious social consequences of evolving demographics in which employers must navigate diversity and inclusion.

“Reflecting on the falls themselves, we cannot ignore the stark reality of the dwindling water levels that we are currently witnessing -a poignant testament to the unprecedented drought gripping our nation and other parts of Southern Africa.”

Nazare observed the sense of overwhelming despair that comes with trying to manage businesses and cope as the pace of change defies traditional tools that operators are all accustomed to.

Adaptation, he noted, is an imperative.

He said, “Finally, as we all appreciate, human activity and natural phenomena breed risk and more than ever before we are called upon to provide cover for risk of increasing complexity.

“Risk ultimately manifests in insurance claims and inevitable contention. Our programme this year includes an intriguing conversation on insurance claims.”

He said the two-day summit was enriched dialogue and meaningful interactive exchanges.

Nazare added that, “This summit is not merely a professional endeavour but also an opportunity for networking, shared experiences and unwinding away from the hustle and bustle of our workplaces. Let us make the most of it.”

Asige a visually-impaired senator, spoke on how the African market could benefit from including disability and gender.

She enlightened on effective ways of communicating with the disabled.

The senator said companies would gain a lot by improving their recruitment practices to be inclusive, and how they could develop new products for a niche market, and deliver positive change.