CBN retains interest rate at 27.50%

Abdullateef Fowewe

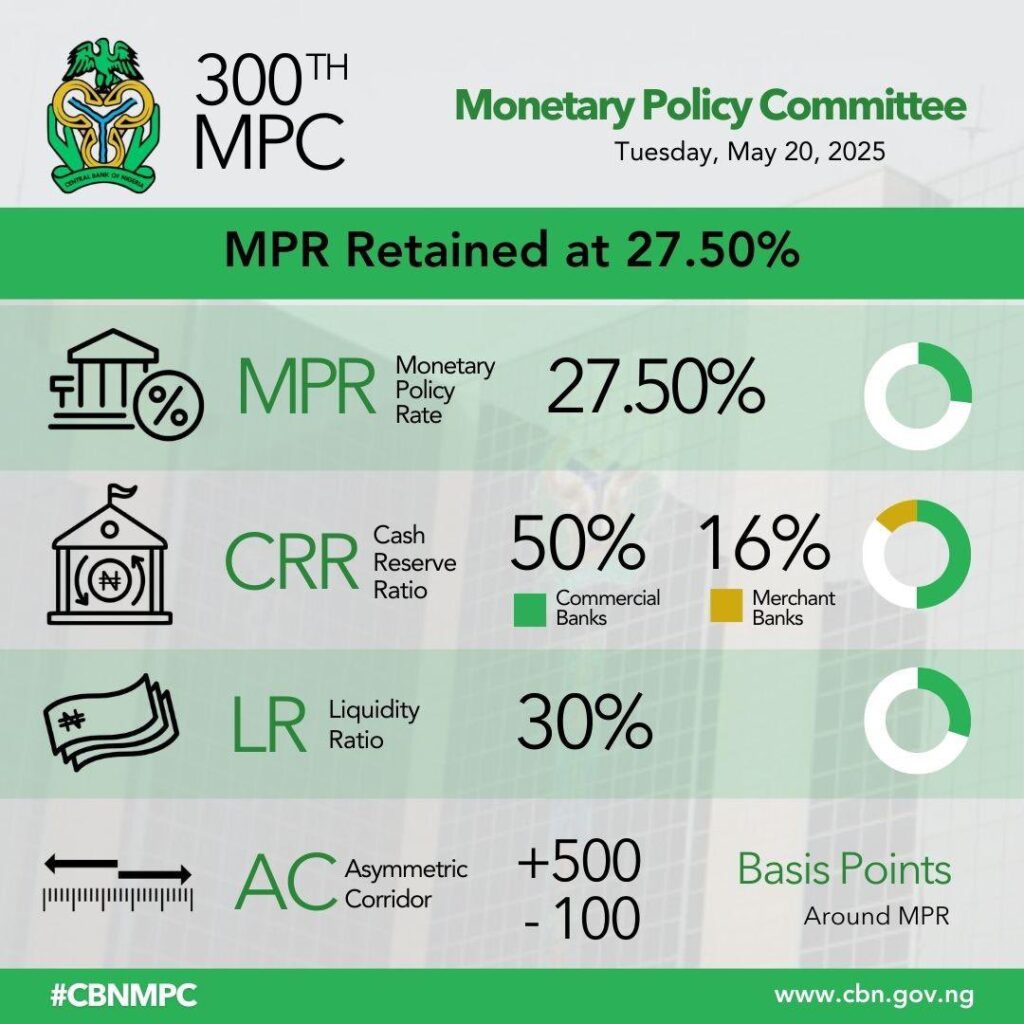

The Central Bank of Nigeria (CBN), on Tuesday, retained the lending rate at 27.50 per cent after its Monetary Policy Committee (MPC) in Abuja.

The MPC of the CBN held its 300th meeting on the 19th and 20th of May 2025, and reviewed developments in the global and domestic economies including the risks to the outlook. All twelve members of the Committee were in attendance.

At the meeting, the Committee was unanimous in its decision to hold policy and thus decided to retain the MPR at 27.50 per cent;Retain the asymmetric corridor around the MPR at +500/-100 basis points; Retain the Cash Reserve Ratio of Deposit Money Banks at 50.00 per cent and Merchant Banks at 16 per cent; and retain the Liquidity Ratio at 30.00 per cent.

Speaking on the considerations, the Governor, CBN, Olayemi Cardoso, said the MPC noted the relative improvements in some key macroeconomic indicators which are expected to support the overall moderation in prices in the near to medium term.

These include the progressive narrowing of the gap between the Nigeria Foreign Exchange Market (NFEM) and Bureau De Change (BDC) windows, the positive balance of payments position, and easing price of PMS. Members also noted with satisfaction the progressive moderation in food inflation and, therefore, commended the government for implementing measures to increase food supply as well as stepping up the fight against insecurity, especially in farming communities.

He said, “The MPC, thus, encouraged security agencies to sustain the momentum while government provides necessary inputs to farmers to further boost food production. The Committee, however, acknowledged underlying inflationary pressures driven largely by high electricity prices, persistent foreign exchange demand pressure and other legacy structural factors.

“The MPC noted new policies introduced by the Federal Government to boost local production, reduce foreign currency demand pressure, and thus, lessen the pass-through to domestic prices. Given the relative stability observed in the foreign exchange market, Members urged the Bank to sustain the implementation of the ongoing reforms to further boost market confidence. The Committee also called on the fiscal authority to strengthen current efforts at enhancing foreign exchange earnings, especially from gas, oil and non-oil exports.

“The MPC, however, expressed concerns about the recent decline in crude oil prices, attributable to increased production by non-OPEC members as well as uncertainties associated with U.S. trade policy, which present new challenges for fiscal receipts and budget implementation.The Committee reaffirmed the continued stability of the banking system following notable improvements in key performance indicators and observed the appreciable progress in the ongoing recapitalization exercise.”

Members called on the Bank to sustain its effective oversight of the industry to ensure compliance with regulatory and macroprudential guidelines.

“On the strength of these considerations, and driven by the continued uncertain policy environment, exacerbated by ongoing global shocks, members weighed the available policy options and were unanimous in their decision to hold policy to enable a better understanding of near-term developments,” Cardoso said.