Consolidated Hallmark Holdings records 117% asset growth in first year as Holdco

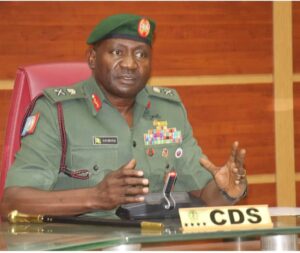

L-r: Eddie A Efekoha, Group Chief Executive Officer, Consolidated Hallmark Holdings (CHH) Plc; Idris A. Shuaibu, Independent Non-Executive Director/Chairman; Rukevwe Falana, Company Secretary/Group Head Legal Compliance & Secretariat, and Babatunde Daramola, Group Chief Financial Officer, during the 2nd annual general meeting of Consolidated Hallmark Holdings Plc, in Lagos, on Wednesday.

Nike Popoola

Consolidated Hallmark Holdings Plc has reported a successful first year of operations as a holding company, delivering impressive financial results for the 2024 financial year.

At the company’s 2nd Annual General Meeting, the Group Chief Executive Officer, Mr. Eddie A. Efekoha, announced a remarkable 117% increase in the Group’s total assets, which rose from N26.2 billion in 2023 to N56.9 billion in 2024.

Reflecting on the milestone, Mr. Efekoha stated, “Our first year as a Holdco recorded significant progress on several fronts, from the smooth transition to a holding structure, to the strong financial performance of our flagship subsidiary, Consolidated Hallmark Insurance Limited, and the successful commencement of our application for a Life Assurance operating licence from the National Insurance Commission (NAICOM), which has now been granted.”

He revealed that the Group’s Profit Before Tax soared by 404 per cent, jumping from N4.7 billion in 2023 to N23.2 billion in 2024. Profit attributable to shareholders also rose significantly to N22.58 billion, up from N3.8 billion the previous year.

Efekoha credited this growth to strategic diversification efforts, saying, “Our investment in equities across various sectors delivered the desired results.”

A key focus of Consolidated Hallmark’s insurance operations remains its commitment to meeting claims obligations. Group Insurance Service Expenses, including claims settled, increased from N12 billion in 2023 to N21.56 billion in 2024. Net expenses from reinsurance contracts during the year stood at N5.6 billion.

“Our disciplined approach to claims management is essential to maintaining market trust, ensuring customer satisfaction, and strengthening our brand value,” Efekoha emphasized.

Chairman of the Board of Directors, Mr. Shuaibu A. Idris, highlighted that the Group achieved strong results across all major financial indicators. Insurance revenue grew significantly from N15.7 billion in 2023 to N29.42 billion in 2024.

“Our financial performance reflects a strong outing, despite challenges in both the local and global operating environment,” Mr. Idris said. “We are pleased to report that our first year as a Holding Company was a resounding success.”

A key driver of this performance was the Group’s strategic investment in the oil and gas sector, which the Chairman described as a “game changer” that is now yielding substantial returns after years of investment and development.