Currency in circulation rises by N40bn in two months- CBN

Nike Popoola

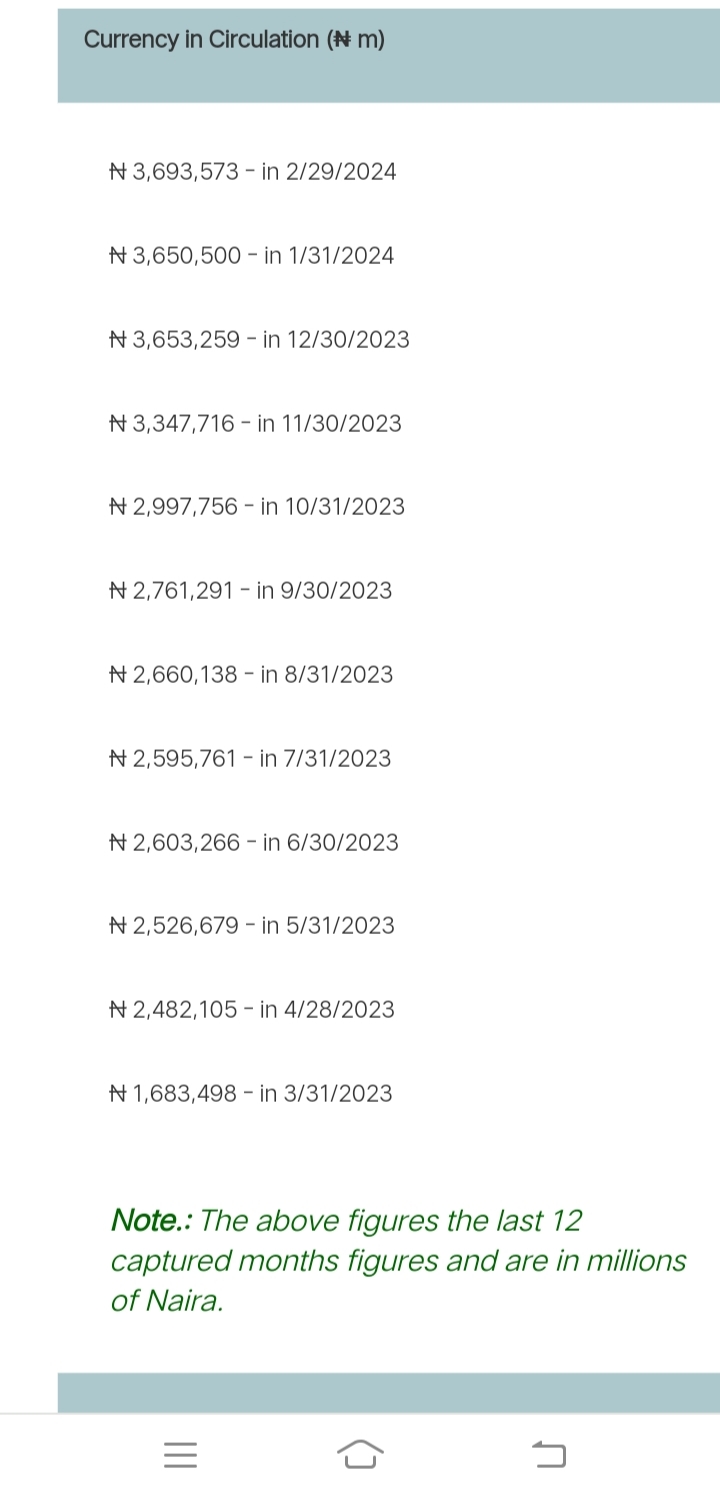

The currency in circulation in Nigeria rose by N40bn to N3.693tn at the end of February 2024, from N3.653tn at the end of December, 2023.

Figures obtained by Daily Economy, from Central Bank of Nigeria’s data on Currency in Circulation (CIC) revealed on Wednesday.

The figures showed that the CIC which commenced February 2023 at N982.097tn, rose to N1.638tn, N2.482tn and N2.526tn in March, April and May.

According to the figures obtained by Daily Economy from the CBN, the figures rose to N2.603tn in June, fell to N2.595tn in July, and up to N2.66tn in August.

The figures were N2.761tn in September, N2.997tn in October, N3.347tn in November and N3.653tn in December.

According to the CBN, CIC can be defined as currency outside the vaults of Central Bank, that is, all legal tender currency in the hands of the general public and in the vaults of the Deposit Money Banks.

The Central Bank of Nigeria employs what is referred to as the “accounting/statistical/withdrawals & deposits approach” to compute the CIC in Nigeria.

This approach involves tracking the movements in CIC on a transaction by transaction basis. That is, for every withdrawal made by a Deposit Money Bank (DMB) at one of CBN’s Branches, an increase in CIC is

recorded, and for every deposit made by a DMB at one of CBN’s branches, a decrease in CIC is recorded.

The transactions listed above are all recorded in the Central Bank’s Currency In Circulation account, and the balance on the account at any point in time represents the country’s Currency in Circulation.

The accuracy of the CIC figure reported on the CBN’s website is a function of the postings made into the CIC account of the Bank at the 37 branches across the country.

The CBN however operates a robust reconciliation/call-over system which serves to highlight erroneous or non-impacted postings made into the CIC account in order to have them resolved within the shortest possible time. This ensures that the CIC figure reported by the CBN at any point is free from material error.