FG, NCRIB emphasize insurance relevance to blue economy

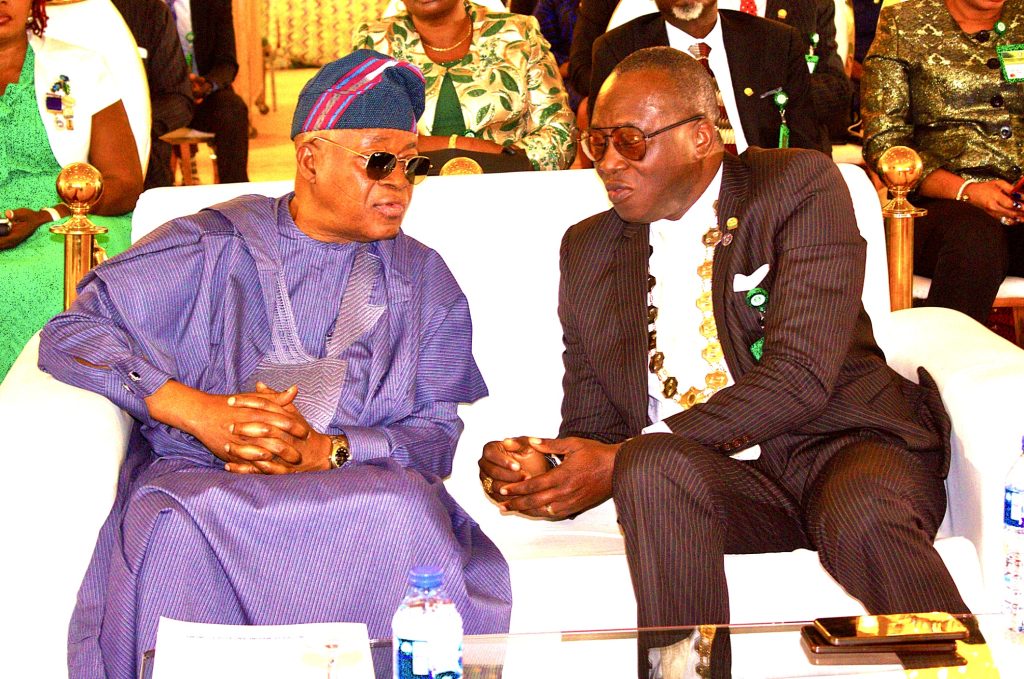

Hon. Minister for Marine and Blue Economy, Alhaji Gboyega Oyetola discussing with the President, Nigerian Council of Registered Insurance Brokers, Prince Babatunde A. Oguntade at the 2024 National Insurance Brokers Conference and Exhibition held at Banquet Hall, State House, Abuja

Nike Popoola

The Federal Government and the Nigerian Council of Registered Insurance Brokers, have emphasized the relevance of insurance to blue economy.

They spoke at the 2024 National Insurance Brokers and Exhibition event of the Nigerian Council of Registered Insurance Brokers (NCRIB), which held in Abuja recently.

The Minister of Marine and Blue Economy, Adegboyega Oyetola, while presenting a paper titled, ‘Insurance and Blue Economy: Connecting the knots’, said, marine insurance is a type of insurance that covers losses or damages incurred at sea or inland waterways, providing financial protection for ships, cargo, and other property involved in maritime trade.

According to him, marine and blue economy is the sustainable use of ocean resources to benefit economies, livelihoods, and preserving ocean ecosystem health

He said, “Considering the potential of the blue economy to serve as a significant driver of economic growth and sustainable development, it is exposed to various risks from public and private contracts, tariffs, local and international regulations, natural disasters, climate change, hence the importance of veritable insurance framework in mitigating these risks and fostering growth and development of the sector.

“Insurance plays a vital role in the blue economy space ensuring risk mitigation covering traditional maritime risks like hull and cargo damage, liability, and piracy, addressing emerging risks like sea-level rise, extreme weather events, and ocean acidification and protecting investments in innovative technologies like offshore renewable energy and aquaculture.”

He noted that, It also plays an important role in creating a good enabling environment for investments by fostering investor confidence by insuring against risk in the maritime space thereby attracting investment to the sector, facilitating access to finance for sustainable ocean-based projects, incentivizing sustainable practices by offering lower premiums to businesses with strong environmental and social performance and supporting ecosystem services by protecting and restoring marine ecosystems by covering losses from natural disasters and pollution.

President & Chairman, governing Board of Council, NCRIB, Prince Babatunde Oguntade, said, the theme of this year’s conference, Insurance: The Untapped Goldmine reflects focus on navigating the complexities of the industry, embracing technology, and capitalizing on emerging opportunities.

He said, “We are conscious of the government’s efforts to take the nation to her Eldorado. The role and importance of insurance cannot be undermined in this process. Government should see insurance Industry as valuable partner in this journey.

“As we navigate the challenges and opportunities of our nation, our industry remains committed to its core values of integrity, professionalism and service. We will continue to advocate for policies and regulations that promote a level playing field, enhance consumer protection, and foster sustainable growth.”