Growing concerns as more firms exit market landscape

Source: CBN’ Business Expectations Survey (BES) November, 2024

According to the Manufacturers Association of Nigeria, no fewer than 767 manufacturers shut down operations in 2023. While this worrisome occurrence has persisted over the years, industry experts have advised businesses in the country to brace up for more challenges in the coming year, Abdulateeef Fowewe reports.

After 51 years of operating in the country, GSK UK Group informed GlaxoSmithKline Consumer Nigeria Plc of its strategic intent to cease commercialization of its prescription medicines and vaccines in Nigeria through the GSK local operating companies, and transition to a third-party direct distribution model for its pharmaceutical products.

The Group informed the Board of its intent to terminate its distribution agreement and to appoint a third-party distributor in Nigeria for the supply of the consumer healthcare products in 2023.

For the above reasons, and having, together with GSK UK, evaluated various other options, the Board of GlaxoSmithKline Consumer Nigeria Plc concluded that there was no alternative but to cease operations.

This multinational was just one of many that had taken the difficult decision to exit the country, leaving huge vacuum behind.

In addition to helping to preserve foreign exchange in the country, GSK was a major employer of labour, empowering Nigerians.

It is worth of note that developed countries have continued to advance as they record boom in economic activities, due to a more conducive operating environment.

By this, they are able to boost their exports and generate more revenue for developmental purposes.

Unfortunately, the reverse has been the case in Nigeria, with many of the multinationals, as well as Small and Medium Enterprises dying, or relocating to other neighboring countries.

This further worsens Nigeria’s economic woes because it grows further as an import-dependent country, unable to generate enough foreign exchange to meet its local needs.

After 15 years of being a fashion designer in Adangba area of Ilorin, Akin Ahmed, left the occupation and started riding motorcycle popularly known as Okada to carry passengers.

He lamented that the purchasing power of those in his community had drastically reduced due to economy challenges, yet, he needed to pay for this shop, as well as get alternative power supply because of the epileptic supply of electricity.

According to him, “People now sew clothes for special occasions because their purchasing power reduced. I have to buy petrol to fuel my generator regularly which is very expensive because we hardly have light.

“Buying petrol became expensive as the government continued to increase fuel price. Less than two years ago, we were buying a litre of petrol for less than N200, but now, it is more than N1,000 and very unsustainable.”

“The landlord increased the rent for the shop, and yet, there’s no power to operate. I devised using charcoal iron but the business is still not sustainable. I had to shut down operations and now drive okada. Life has not been easy since then.”

Power supply is one of the challenges confronting SMES in the country. Many have to source for alternative power sources, using generators and solar which are extremely expensive.

Mama Kemi used to have a cold store in Agege where she sold frozen fish, chicken and turkey. She shut down the business because she couldn’t get affordable power to preserve her goods.

She said, “We hardly have electricity power supply so we have been running on generators. Before, we bought petrol for N189/litre, now it is N1,080/litre which is not sustainable.

“We were being given estimated electricity billing which we cannot afford, even as we have not been able to get prepaid meters.”

Closures

According to the Manufacturers Association of Nigeria (MAN), 767 manufacturers shut down operations while 335 became distressed in 2023.

This is in addition to many companies that have shut down in previous years, as well as petty traders that difficult operating challenges keep on sniffing the life out of them.

In a statement to react to introduction of Expatriate Employment Levy by the Federal Government, MAN stated, “The manufacturing sector is already beset with multidimensional challenges. In the year 2023, 335 manufacturing companies became distressed and 767 shut down.”

The impact of some of the companies that were major employers of labour, and contributed significantly to the economy, that have exited down in recent years cannot be overemphasized.

Some of the multinational companies that exited in 2024 include PZ Cussons Nigeria Plc, Kimberly-Clark Nigeria, Diageo Plc and Microsoft Nigeria.

In 2023, ShopRite Nigeria, Sanofi-Aventis Nigeria Ltd, Equinox Nigeria and Bolt Food & Jumia Food Nigeria among others succumbed to economic challenges, exiting the country.

Companies including Errand Products Nigeria Ltd, Gorgeous Metal Makers Ltd, Universal Rubber Company Ltd, Mother’s Pride Ventures Ltd, among others had exited in 2022.

A major event in Nigeria in 2023 was the removal of fuel subsidy by President Bola Tinubu.

Fuel subsidy removal is the Federal Government’s decision to remove subsidies for petroleum products, such as gasoline and diesel, which are often used to keep fuel prices lower than market rates.

On May 29, 2023, President Tinubu announced the end of fuel subsidies in Nigeria. This led to a significant increase in the price of fuel, which in turn increased the cost of living for citizens.

The Nigerian Association of Small-Scale Industrialists (NASSI), Nigeria’s umbrella body of small-scale industrialists, saw it as a complex and controversial subject, particularly for small-scale industries that rely heavily on affordable energy and transportation costs.

While analyzing the impact in its report titled, ‘Impact of subsidy removal by President Bola Tinubu on Small-Scale Industries in Nigeria: Analysis, mitigation strategies, and recommendations’, NASSI states that the decision by Tinubu to remove subsidies will have increase operational costs.

It states, “Subsidy removal will likely lead to an immediate surge in fuel prices, resulting in higher energy costs for small-scale industries. This increase in operational expenses can strain profit margins, making it challenging for these enterprises to maintain their competitiveness.

According to NASSI, small-scale industries often face logistical hurdles, and higher fuel prices can exacerbate this issue.

It states that, with subsidy removal, transportation costs are likely to escalate, making it more expensive to transport goods and materials. This can disrupt supply chains, delay deliveries, and negatively impact the overall efficiency of small-scale industries.

Implications

According to the Director-General, Lagos Chamber of Commerce & Industry (LCCI), Dr. Chinyere Almona, the persistent rise in the inflation rate, reaching a 28-year record high of 34.60 in November 2024, continues to fuel a tense business environment as elevated prices constrain various business operations.

The LCCI expressed concerns, particularly with the persistent and unabated rise in inflation, urging businesses to prepare for more stress from the burden of higher interest rates ahead of 2024.

Almona said, “With the raging inflation rate, the unsuccessful attempt of the Central Bank to reduce the currency in circulation, and approaching a high-spending festive period, we are set to contend with even higher interest rates as the expected outcome from the next decisions by the CBN Monetary Policy Committee (MPC).

“The high inflation rate has far-reaching implications. One of the primary effects is reduced consumer spending. High food and core inflation erode disposable income, reducing demand for non-essential goods and services.

“Businesses also face increased business costs, as rising transportation, rent, and energy costs elevate production expenses, shrinking profit margins.

Moreover, the uncertain macroeconomic environment weakens the investment climate, deterring both local and foreign investments. Persistent high inflation further threatens economic growth by diminishing the competitiveness of domestic industries and stifling expansion.”

Challenges

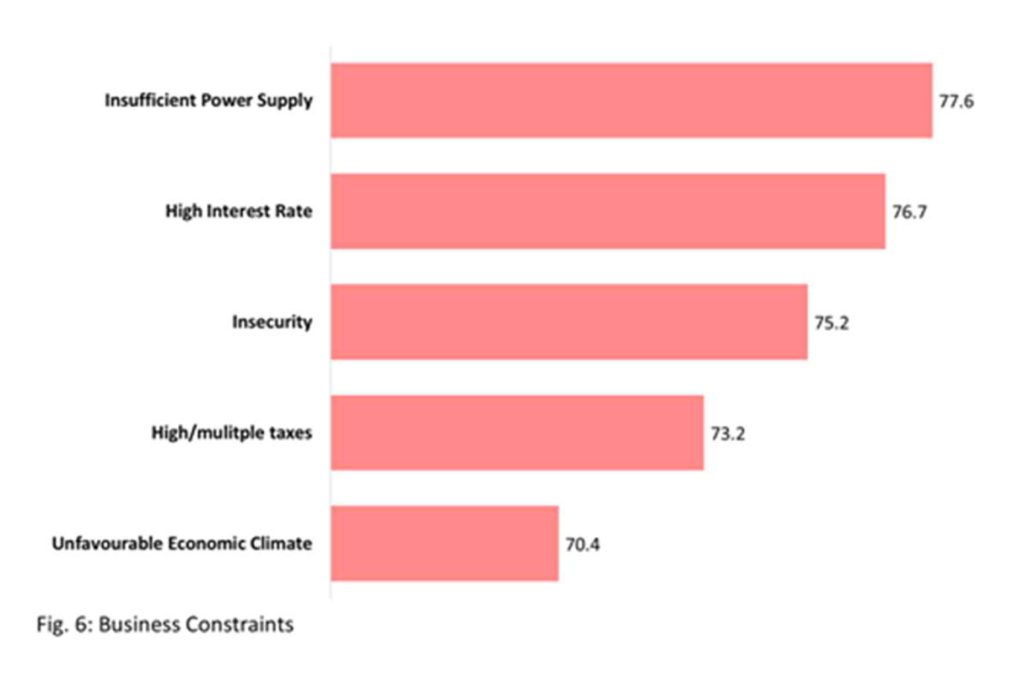

The report on Business Expectations Survey (BES) November, 2024 by the Statistics Department Economic Policy Directorate of the Central Bank of Nigeria (CBN), shows that respondents mentioned insufficient power supply, high interest rates, and insecurity as top business constraints for November 2024.

The BES is a monthly survey of leading businesses drawn from Business Establishment updated frames of Central Bank of Nigeria and the National Bureau of Statistics (NBS). The BES result provides advance indication of change in the overall business activity in the economy.

Procter & Gamble (P&G) P&G started operation in Nigerian in 1993, investing millions of dollars in the economy, which had led to increased activities and employment in the sector.

Despite expansion recorded since its operations, its $300m plant in Agbara, Ogun State, shut down one year after its completion in 2017.

As it continued to grapple with operational challenges, it announced in 2023 that it was leaving Nigeria by shutting down its manufacturing operations and becoming an import-only business.

According to P&G’s Chief Financial Officer, Andre Schulten, this was due to the difficulty to operate in Nigeria due to the macroeconomic environment and the challenges of creating U.S. dollar value.

The International Monetary Fund (IMF) states that lack of access to reliable electricity costs the Nigerian economy an estimated US$29bn a year.

According to PWC MSME Survey Report 2024, approximately one out of every seven firm exits the economy because of this.

Other structural challenges such as multiple taxation, inadequate manpower and insecurity requires investment from the government and private sector to address, the report notes.

PWC states that, “Nigeria’s Micro Enterprises (ME) accounted for 96.9% while SME’s accounted for 3.1% of the total number of businesses in the country. MSMEs contributed about 46.3% to the national GDP, accounted for 6.21% of gross exports and employed over 84% of total workforce as of 2020.

“In terms of ownership structure, 96.2% of MSMEs are sole proprietorships while 3.3% are Partnerships, faith based organisations (0.1%), and others (0.4%).”

The surveyed MSMEs reported that the top factors hindering their growth include inadequate access to finance, poor electricity, multiplicity of taxes & levies, inadequate man power, insecurity and government policies.

Funding, it notes, is a critical enabler of the growth and development of small and medium enterprises.

35% of the businesses surveyed mentioned inadequate access to finance as their number one challenge.

Although, the government has instituted development finance programmes such as the N500bn debenture stock approval by CBN and the N70bn MSME Development Fund.

It states, “Infrastructure challenges especially electricity accounts for the biggest costs to the daily operations of MSMEs. 21% reported that power is a major challenge to their business growth.

“Nigeria’s power sector is overwhelmed by myriad of challenges including deteriorating plants/units’ capacities, poor maintenance, inadequate gas supply, limited distribution network and commercial viability of Discos operation among others has had adverse impact on the business environment in Nigeria; consequently, contributing to significant economic costs to MSME and economic growth.”

67% of surveyed MSME reported that there has been a decrease in the demand for their products or services. When asked the reason for the decline, 38% attributed it to the high cost of their products and 36% reported that the low purchasing power of consumers were the major reasons for the decline.

The decline in demand for their products/services over the past two years was due to macroeconomic headwinds such as inflationary pressures, depreciation of the currency, and slow economic growth.

Furthermore, While 12% reported that the decline was due to consumers switching to alternatives, 10% attributed it to changing consumer preferences.

Some of the key findings in the 2024 MSME survey by PWC are, “Over 50% of surveyed MSMEs reported that decline in demand for their product or service is attributed to higher retail prices and low purchasing power of customers; Inadequate access to finance, poor electricity, multiplicity of taxes among others hindered the growth of of MSMEs;

“Family and friends, bank loans, overdraft and credit lines, remain the top sources of funding for the surveyed MSMEs; High interest rate, several procedural requirements, and insufficient collateral were the top hindrances to accessing loans for the surveyed MSME’s.”

It adds that, “Most of MSMEs in Nigeria pay one to five taxes with 65% citing VAT as their primary paid tax; High cost of energy significantly impacted the surveyed MSMEs as over 60% depend on the national grid and alternative sources; Majority of MSMEs surveyed acknowledge the importance of technology and are harnessing its power to promote their businesses.”

Way forward

The PWC report advises on what the government and other stakeholders should do to create a thriving business environment for MSMEs.

These are a collaborative effort from various stakeholders; Government must implement clear, consistent, and business-friendly policies that minimise bureaucratic hurdles and administrative burdens.

This includes streamlining business registration processes, simplifying tax regulations, providing tax breaks and enacting policies that encourage innovation and competition; Facilitate access to finance for MSMEs through various channels, including loan guarantee schemes, microfinance institutions and angel investor networks and venture capital;

“Investment in infrastructure development, such as reliable transportation networks, affordable energy access, and robust communication technology, to create a conducive environment for businesses to operate and grow; Collaborate with educational institutions and training providers to offer relevant skills development programs that equip individuals with the necessary skills to succeed in the MSME sector.”

The Director/Chief Executive Officer, The Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, who is a former Director-General of the Lagos Chamber of Commerce and Industry (LCCI), says that high inflationary pressure was a major concern in 2024.

He mentions the impact on the economy to include general increase in the cost of living with consequential effect of aggravation of the poverty situation, elevated cost of operations and cost of production for businesses, significant erosion of profit margins of many businesses as additional costs could not be transferred to consumers because of weak purchasing power of consumers.

Other impacts, he notes are elevated risk of loan defaults and high project costs across all sectors of the economy, with many cases of abandoned projects resulting from unforeseen cost escalation.

Given suggestions on way forward, Yusuf says government should expedite action to expedite boost capitalization of the development finance institutions – BOI, BOA, NEXIM to deepen development finance interventions.

According to him, ““There is a need to protect the real economy from the adverse consequences of free market principles. This is the basis of government intervention in a market economy.”

To be resilient, Yusuf advises business owners on, “Leveraging technology to reduce cost and ensure competitiveness; Industries need to deepen backward integration to reduce the forex exposure; Reduction in debt financing to reduce the burden of high interest rate; Adoption of efficient energy solutions to reduce the pressure of high energy cost.”